Question: Can Money Supply Figures Accurately Predict The Economic Future?

A short answer to the above question:

No ,

they cannot!

That is, they cannot and should not be used to predict the future state of the economy.

Every Last Penny?

However, if you dear reader, [or the author of the article discussed below], firmly believe that money supply figures can be used to reliably predict the future economic environment, then logically, you/they should have no problem with putting all , [ie every last penny!] of your hard earned savings into whatever "investment" that you know "for certain" is going to benefit from whatever it is that you "know" is coming, because you simply cannot fail to "win big" this time around, right?

If you're not prepared to do that, then that would seem to indicate that you are not prepared to risk all of your savings on a supposedly "certain"

economic future, right?

As Dirty Harry famously asked:

"Do ya feel lucky, punk? :-)

Reality Fact:

Money supply figures/graphs etc. cannot/do not accurately predict the future state of the economy [although you might get lucky, regardless].

Of course, all previous F.S.S. clients already understand this very important point:

[But maybe some of them need to be reminded of that fact of reality :-( ]

Why Is This So?

If you are not a current or former client , and feel the need to fully understand, in excruciating detail, exactly why money supply [or any other] figures/graphs etc. cannot and should not be used to "reliably" predict future economic activity, then you can email me at : onebornfreeatyahoodotcom

and I'll give you my current exorbitant rates for such explanations! :-) .

Free Advice?

On the other hand, a link to some totally free investment/speculation advice is given at the close of this post.

And so, finally, to the article in question:

What? A "Miseian" Economist Contradicting Von Mises?

What is most interesting to me about the article linked above that I focus on here, is that the author, Mr Ryan McMaken, publishes his findings and conclusions at the Von Mises Institute website.

He says, in part:

"Money supply growth can often be a helpful measure of economic activity and an indicator of coming recessions" .

However, Mr McMakens primary influence in economic philosophy, Ludwig Von Mises [presumably], has himself stated :

[More similarly relevant Von Mises quotes

here.]

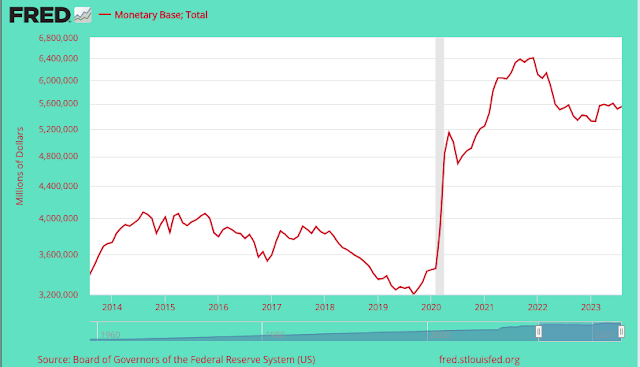

Mr McMaken also illustrates his article with a graph which illustrates growth in the M2 money supply from 1988 through March 2023:

Fig.1 . McMaken/Von Mises Institute graph of M2 Money Supply, Percentage Rate Change 1988 -2023

No Log Scale? Creating A False Impression?

[A Lesson I Learned Directly From Harry Browne]

As you can see, according to the graph above there seems to have been a huge decline in M2 since its peak in the years 2020-21.

However, I would say that the above graph gives a very misleading impression.

I mentored under financial advisor

Harry Browne and subscribed to his wonderful investment newsletter , "Harry Browne's Special Reports", for 10 years ['86-'96].

One of the many valuable lessons he taught me over the years was how to read and construct financial data graphs, and of the usefulness of using a

logarithmic [log.] scale for the vertical [left or right side] scale of a standard graph when appropriate, especially in the case of money supply graphs, as this will reveal percentage changes in volume between _any_ two points shown on the graphs horizontal axis.

The far more commonly used

linear scale, which does not accurately depict volume changes percentage-wise between any two points on the horizontal axis, is usually more visually dramatic, which is mostly why it gets used.

[Either that, or ignorance, or maybe dishonesty.]

If you check my other graphs

here, you will see that the majority of them use a log scale. [As well as subscribing to Harry's newsletter for 10 years, in order to get the latest updates on Fed money supply figures, which at that time I followed somewhat religiously :-(, I also, pre- internet, of course, subscribed to the monthly Federal Reserve Bulletin, plus numerous other alleged "economic indicators" and various "economic and investment forecasting" financial advisor publications. Ah!, those were the days!].

To illustrate my point regarding the use of log scale graphs, lets take a look at the same data for M2 shown in Mr McMakens graph, for the same time period ['88-'23], but using a log scale:

Fig.2 M2 money supply '88-'23 [log scale]

A big difference, right?

Now for comparison lets look at M2 over the same time period using the far more common, and more visually dramatic, linear scale, where the percentage change difference in volume between any two points on the horizontal is not represented:

Fig.3 M2 money supply '88-'23 [linear scale]

Notice how much more dramatic the upwards trend in M2 looks, especially after 2020, when a linear scale is used instead of a log scale.

Now lets look at the same data for the last two years, first from Mr McMaken's Von Mises Institute graph, and then using my own log scale graph:

Fig.4 M2 money supply '20-'23,

[Von Mises Inst. article graph]

Fig.5 M2 money supply [log scale] '20-'23

As can be easily seen, the drop in M2 for those last two years looks a lot less dramatic when the log scale is used instead of the way that percentage change is represented in Mr McMakens graph.

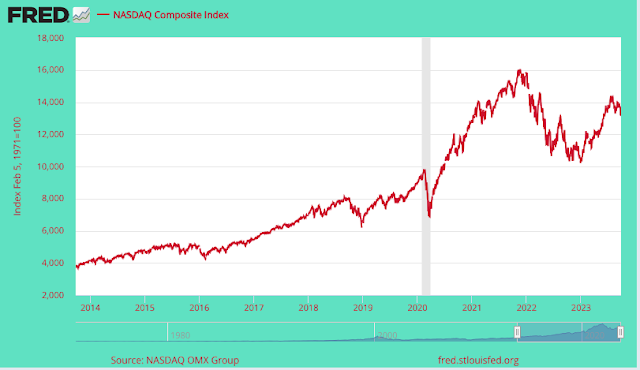

Conclusions?

Regardless of whether a graph uses a log, or linear scale, or some other scale formula, that graph, regardless of what it portrays [money supply , stock market, bond market, precious metal or other price/value changes], is not a reliable indicator of future price/valuation changes.

As I said earlier, its not impossible to accidentally be right with an economic or investment prediction based on graphs, and if that happens, the trick is to not then conclude that the author of such a prediction can reliably see the economic future, but to instead conclude that he/she just got lucky this time around.

To that end, I would suggest a close reading of: "Confessions of a Mr. X", at the end of Harry Browne's excellent

"The Economic Time Bomb" book.

Related articles:

[This one gives a similar opinion to Mr McMaken, complete with an equally misleading graph, used for dramatic effect, no doubt :-) ]:

FSS articles on money supply: