Fig. 1: Federal Reserve monetary base [M.B.] growth 1959-2013 [Click on image to enlarge]

N.B. This article is in no way to be considered as an endorsement of either the Federal Reserve System [which this year celebrates the 100th. year of its existence] nor of any of its previous or current members . To view the long term [1913-2000] effects of the Federal Reserves existence on the value of the $U.S. , see Fig. 8 at the close of this article: "$US Price Inflation Under The Federal Reserve System [1913-2000].

Article Explanation:

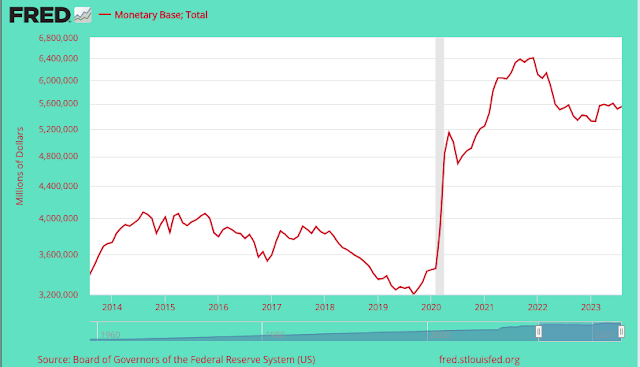

The graphs shown above and below are my attempt to graphically illustrate how much the monetary base, [i.e. the narrowest measure of the Federal Reserve's money supply measures, known a "MB" in financial circles ], has expanded under the various Federal Reserve Board of Governors Chairmen who preceded Mr. Ben Bernanke, who took his chairman position in 2006 , and to try to put into some sort of broad perspective for the interested person, investor or speculator, the visible results of Mr Bernanke's chairmanship to date; by demonstrating just how much the Federal Reserve's monetary policy under Mr Bernanke's leadership has differed from [even] the amazing excesses of all of his predecessors, at least as far as can be construed for the period examined [ from 1959 through 2013].

As you will see, when examined on an individual basis, almost all of the previous chairmen examined [1959-2006] have had exceedingly unsteady hands on the "steering wheel" called the monetary base.

And yet now, every one of the previous 5 holders of Mr Bernanke's current position that span the period 1959-2006 pale in comparison when viewed within the "big picture" [see Fig. 1 above], and actually appear downright "conservative" by comparison to Mr Bernanke.

Outside of Mr Alan Greenspan, not one of them comes close to replicating what has to date occurred under Mr Bernake's chairmanship, especially since the 3rd. quarter of 2008.

Investment/Speculation Implications? :

The article closes with a graph depicting the massive loss of purchasing power of the $U.S. from 1913 [when the Federal Reserve came into existence], through the year 2000, and closes with a few observations which may or may not be of interest to the investor or speculator.

Explanation: "Monetary Base" :

The monetary base [MB] is the narrowest measure of the Federal Reserve's monetary measures. The next narrowest is called "M1", and the next narrowest is "M2". The broadest measure of all is called "MZM". The Federal Reserves monetary measures, as well as a lot more financial data, are regularly published and updated here.

For more information on the various definitions of the Federal Reserves money supply measures, please see here.

Explanation: Logarithmic [Log] scale [also called a "Ratio Scale"] .

All of my graphs for this article use what is called a "Logarithmic scale" for the "Y" [or vertical] scale, simply because a logarithmic scale makes it easy to show percentage increases/decreases on the "Y" [vertical] axis, between any two points in time along the horizontal "X" axis of the graph. More information on logarithmic, or ratio scales, can be viewed here.

Explanation: "Monetary Inflation" Is Not "Price Inflation"!:

The title of this article is: "Ben Bernanke, the Great[est] Inflator?" and concerns monetary inflation, not price inflation.

It attempts to graphically illustrate how under Mr Bernanke, the base monetary supply [M.B.] has been to date inflated [i.e. increased] in excess of 275%, a percentage increase for the monetary base that exceeds that of any of his predecessors for the period charted [1959-2013].

By way of direct comparison with Mr Bernanke's tenure, approximate resultant percentage increase figures in the monetary base for each of the 5 Fed chairman [1959-2006] during their own terms are also given below.

Please understand, monetary inflation is not the same phenomenon as price inflation [i.e. a general, steady accelerating increase in the price of most consumer goods, due to a steady to accelerating decrease in the real-world value of each unit of a currency ].

The Complete Time Line History of Federal Reserve Board of Governors Chairmen 1913-2013:

As I have already mentioned,the F.R.E.D published monetary base figures I have used to construct my graphs start in Jan. 1st. 1959, that is, a little under half way through the chairmanship of the 9th chairman, Mr McChesney Martin Jr.

For a complete list that includes the previous 8 who preceeded Mr McChesney Martin Jr. [i.e. from 1913-1951] click here

Fed Chairman 9: William McChesney Martin, Jr. April 2, 1951 –January 31, 1970 :

Mr McChesney Martin has to date been the longest "reigning" chairman of the Federal Reserve Board - his tenure spanned an unprecedented 19 years.

Under this tenure, according to Federal Reserve [F.R.E.D.] on-line records starting 01/01/59, through 01/01/70 , the monetary base steadily increased from around $50 billion to a little over $75 billion- a 50% increase over the course of the last 11 years of Mr W.M. Martin Jr's chairmanship:

Fig. 2 The Monetary Base under W.M. Martin Jr 1959-70 [Click on image to enlarge]

Fed. Chairman 10 Arthur F. Burns February 1, 1970 –January 31,1978:

The monetary base goes from around $75 billion at the start of his term to around $140 billion at its close- a [albeit comparatively smooth -compared to other Fed chairman 1959-2013], roughly 85% increase in the monetary base - which is a roughly 35% greater increase in the monetary base in 8 years than W.M. Martin Jr managed in his own last 11 years. [Way to go, Arthur!] :

Fig.3 The Monetary Base under Arthur F. Burns 1970-1978 [Click on image to enlarge]

Fed Chairman 11: G. William Miller March 8, 1978 –August 6, 1979 :

The short, 16 month only term of the 11th chairman of the Federal Reserve, G. William Miller [March 8, 1978 –August 6, 1979], resulted in a more than 15% increase in the monetary base over 16 months, roughly 10% per year. This may not seem like a lot , but keep in mind, if compounded at an approximate 10% per year rate over a typical 8 year chairperson time period , that 10% annual increase compounded would have resulted in a roughly 110% increase in the monetary base [ in other words Mr Miller's actions were on track to exceed the excesses of his immediate predecessor, A.F. Burns] :

Fig.4 The Monetary Base under G. William Miller 1978-79 [Click on image to enlarge]

Fed Chairman 12: Paul A. Volcker August 6, 1979 – August 11, 1987 :

From 1979 to 1987, under Mr Volker's chairmanship, the monetary base went from around $145 billion in 1979 to over $250 billion by 1987, an approximately 70% increase in the monetary base over 8 years:

Fig.5 The Monetary Base under Paul Volker 1979-1987 [Click on image to enlarge]

Fed Chairman 13 . Alan Greenspan August 11, 1987 –January 31, 2006:

Under Mr Greenspan's term, the monetary base can be seen to have gone from around $250 billion in 1987 to $800 billion in 2006, a roughly 220% increase in the monetary base over a 8 year period.[ A new record for monetary base expansion.]:

Fig.6 The Monetary Base under Alan Greenspan 1987-2006 [Click on image to enlarge]

Fed Chairman 14 : Ben Bernanke February 1, 2006 –

Not to be outdone by his immediate predecessor Alan Greenspan [who himself had overseen an approximately 220% increase in the monetary base over 8 years], under the leadership of Mr Bernanke, the monetary base has gone from $800 billion to more than $3000 billion [i.e.$ 3 trillion] , an approximately 275% increase in the monetary base over a 7 year period. A roughly 50% increase over what Mr Greenspan "achieved". What's not to like ? :-(

Fig.7 The Monetary Base under Ben Bernanke 2006-13 [Click on image to enlarge]

N.B. One thing to keep in mind about the above graph [fig. 7], is that a logarithmic scale tends to flatten out/ make less obvious changes in the vertical [y ]axis along the time line of a graph, and yet here, despite the logarithmic scale, we can still see a dramatic almost vertical increase in the monetary base that occurred in the 3rd quarter of 2008, which should drive home to the observer just how dramatic, substantial, and fast this increase occurred. The monetary base in fact doubles [i.e. 100% increase] in the last 6 months of 2008.

$US Price Inflation Under The Federal Reserve System [1913-2000]:

Fig.8 [Click on image to enlarge]

Investment and Speculation Implications of Bernanke's Monetary Inflation Policies - The Economic/Investment Future Remains Uncertain!

Given my own biases and background education in economics and investment philosophy [i.e. a 25+ year "hard money" and Austrian economic theory background and [self] education], it would seem natural for me to predict that massive price inflation in the US must surely happen within the next 5 or so years, as indeed many of the investment advisors I have followed for the past 25+ years are now doing.

In The Real World....

However, despite the temptation to follow their lead, I will instead tell you that despite what is revealed in this article, the real-world reality is that the economic future, as always, remains entirely uncertain and mostly unpredictable, whether or not it is an "Austrian" economist [or any other type of economist], a "hard money" investment "guru", a technical or fundamental analyst/stock market "guru", Warren Buffet, your financial planner, the Board of Governors at the Federal Reserve, or "Uncle Tom Cobley and all" doing the predicting.

"Austrians"Misunderstanding Austrian Economic Theory?

In fact, as far as Austrian economic theory is concerned, I believe that all "Austrian"/"hard money" economists and investment advisors who are on record as predicting massive inflation [or whatever] in the near future because of what has occurred under Mr. Bernanke's term, have actually misunderstood a key component of Austrian economic theory - but I am not going to address that subject here, nor anywhere else, for free [hint, hint :-) ] ; suffice to say that because of this overlooked key component, the financial/economic future must always remain largely unknowable.

And the above should in no way be construed as me saying that the Federal Reserve is necessary, or is"doing the right thing under the circumstances", or that a stock market boom is now on the cards, or a bond market collapse, or anything else.

I repeat, I have no idea what the future may bring [inflation, deflation, fake "good times","stagflation", or whatever], and the plain vanilla truth is that neither does anyone else [despite whatever successful previous prediction record someone might claim to have.]

For more on the implications for investors and speculators and how to profit/protect your precious savings from both unforeseen economic events, and from all investment prophets, advisors, gurus, economic crystal-ball gazers etc. etc., regardless of what the future might hold, please read the Financial Safety Services disclaimer.

Regards, onebornfree. Financial Safety Services.

*************************************************

More About "Onebornfree":

Live solo example [own composition "Dreams [Anarchist's Blues]:

Youtube link: https://www.youtube.com/watch?v=w0o-C1_LZzk

Onebornfree Personal Freedom Blogsites: