"No one can consistently and accurately predict "big picture" future economic events and scenarios. No investment "expert" advisor, no banker, no money manager, no economist, no politician, no computer algorithm, no fortune teller- not even you :-) [although any one of these, including yourself, might get it right on occasion, purely by chance"- Onebornfree.

***********************************

Whither The Economy? Some Recent "Expert" Market Predictions:

|

| Standard and Poors 500 Stock Index 5 Year performance-[log scale] |

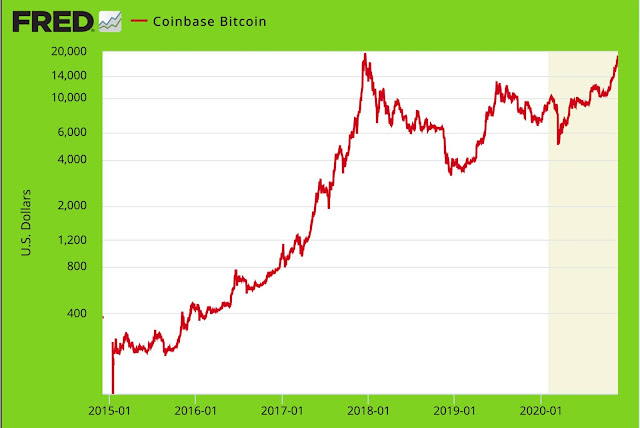

[N.B. more stock market, commodity, crypto-currency, money supply etc. graphs here]

"Expert" Prediction [1]-An Inflationary Depression Is Definitely Coming Soon!:

"In his most recent podcast, Peter Schiff said the service sector is about to follow manufacturing into recession. He also talked about the recent employment numbers and explained how the Fed is acting like a Soviet Politburo.":An Inflationary Depression

https://www.youtube.com/watch?v=aji7x4F4nOI

******************************

******************************

"Expert" Prediction[2]: An October Stock Market Crash Is Definitely Coming!:

“It’s all hype…” “It’s clickbait…” “It’s fearmongering…”. That’s just some of what folks are saying about my prediction that the stock market will crash this month.

I can’t blame them for being skeptical. After all, the financial industry is full of folks who make scary predictions just to capture headlines and get their “15 minutes of fame.” But what if I’m not one of those people?....................And what if I’m noticing that many conditions in the stock market today are eerily similar to conditions that have preceded bear markets before?.....":

**********************************

Financial Safety Services Commentary:

Attention dear reader! This"just"in:

No one can consistently and accurately predict "big picture" future economic events and scenarios. No investment advisor, no money manager, no economist, no politician, no computer program, no fortune teller- not even you :-) [although any one of these, including yourself, might get it right on occasion, purely by chance].

For various underlying, fundamental reasons, the "big picture" financial and economic future must always remain unknown.

And yet,despite the fact that the economic future cannot be reliably/consistently predicted by anyone, it is still possible to easily protect the future value of your savings against the ravages of that unknowable economic future!

*****************************************************

**************************

"If it were possible to calculate the future structure of the market, the future would not be uncertain. There would be neither entrepreneurial loss nor profit. What people expect from the economists is beyond the power of any mortal man." Ludwig Von Mises