What follows is a short generalized examination of the Federal Reserves overall monetary policy during Chairwoman Janet Yellen's tenure, which is apparently due to end in February 2018.

What I did was to visit the Federal Reserve online site and download two graphs showing the monetary base [MB] figures for the periods 2006 -14,[when Yellen's predecessor Ben Bernanke, was chairman, and from 2014 through Oct. 2017 [the most recent figures], the period for which Janet Yellen has been Chairwoman .

Fed chair 2014-18 Janet Yellen

What Is the Monetary Base?

The monetary base is the narrowest measure of the money supply which is manipulated by the Federal Reserve. It is therefor regarded as being the most liquid.

Here's what one financial site says :

"The monetary base is part of the overall money supply. The monetary base refers to that part of the money supply which is highly liquid (i.e. easy to use). The monetary base includes:

~ Notes and coins

~ Commercial bank deposits with the Central Bank

~ The monetary base is also referred to as ‘narrow money’ because it is a narrow definition and doesn’t include more illiquid types of the money supply."

Why Bother With Federal Reserve Monetary Base Figures?

When I first became interested in investing, speculation, and economic theory [over 30 years ago], a lot of the people I looked to for advice watched, amongst other things, the Federal Reserve's monetary base figures in order to try to predict what was going to happen next.

This was especially true amongst the "hard money" and "gold-bug" types whom I mostly followed [ e.g. Doug Casey, Harry Schultz, Harry Browne, Terry Coxon, Richard Russell, John Pugsley, Howard Ruff etc.] .

The notion amongst most of them and others was [and for some apparently still is], that monetary supply inflation inevitably led to the dreaded price inflation that nobody wanted and that last came to pass in the late 1970's and early 1980's.

Bernanke's "Reign" Versus Yellen's "Reign"- A Dramatic Difference

I think you can see a dramatic difference in overall Fed policy between the two "reigns" of Bernanke and Yellen................

1]: Monetary Base Expansion Under Fed Chair Ben Bernanke [ 2006-14]

Lets first take a look at what happened to the monetary base under Mr Bernanke. The graph below shows monetary base figures for 2006-14, and the shaded area [ 2008 - 2009] represents when the last severe recession "officially" started and "officially" ended :-) :

Fig. 2: Federal Reserve Monetary Base, monthly, not seasonally adjusted, Log. Scale, period 2006 - 2014[Fed Chair B. Bernanke]

The Fed's "Quantative Easing" and Price Inflation- 2008- 14

As some of you might know, "Quantitive Easing" was the Federal Reserves new-fangled, fancy term [first used in Japan, apparently] for the large scale "emergency" purchase by it of specified amounts of financial assets from commercial banks and other financial institutions, thus raising the prices of those financial assets and lowering their yield, while simultaneously increasing the money supply, during "the great recession" [ or whatever you want to call it]

As can be seen from the above chart, the increase ["inflation"] of the monetary base via the Fed's"quantitive easing" was enormous, in fact, under Mr Bernanke, the monetary base had an approximate 250 -300 % increase over the 6 years 2008-14]. [See my related article: "Ben Bernanke the Great[est] Inflator?"].

Quantitive Easing To Cause Price Inflation?

At the time, many people [ including various famous "investment advisors" ] assumed that this massive, unprecedented inflation of the monetary base supply [let alone the broader measures of M1, M2, M3 and MZM], was bound to cause massive price inflation in the market place, sooner, rather than later.

No Price Inflation [2008 -18]?

However, obviously, at this time of writing it appears to have not have been the case. Either the assumed inflation is late getting here [historically it is assumed to show up within 3-5 years after the money supply has been initially "over- inflated"], or there was/is something else going on.

Here's what one site says:

"Quantitative easing led to a big increase in the monetary base.The Federal Reserve created money to buy bonds from commercial banks. Banks saw a rise in their reserves.

However, commercial banks didn’t really lend this money out. Therefore the growth of the broader money supply didn’t change much.

What happened is that commercial banks merely oversaw a rise in their reserves.

The US inflation rate was largely unaffected by this increase in the monetary base. Stripping out volatile cost push factors (food and fuel), core inflation remained below 2% inflation target.

If the economy had been booming, and banks were confident to lend, then this increase in the monetary base may have caused an increase in the broader money and inflation..." Source

So, little overall inflation to date apparently, as we head into 2018, for various reasons. [Although some will argue that inflation has occurred in select areas, food for example].

2] The Monetary Base 2014-18 [ Fed Chair J. Yellen]:

Now lets take a look at the monetary base growth under Fed Chair Janet Yellen [2014-18] :

Fig.3: Federal Reserve Monetary Base [MB] 2014- Oct. 2017, [Fed. chair J. Yellen], none-seasonally adjusted, log. scale

A Radical Difference Under Yellen?

As can be seen from the above graph, since Ms. Yellen took office [2014], overall, the Federal Reserve has embarked on a radically different policy from that implemented in mid 2008, and continuing through 2014. What might be called a "tightening" policy, if you will.

In fact, as of October 2017 after steady decline to a low point reached in the last quarter of 2016, and a subsequent increase back to a point where , in Oct. 2017, monetary base figures now seem to be about where they were when Ms Yellen first took office as Fed chair in early 2014.

Summary: What Does It All Mean?

Many will argue that the huge increases in the monetary base under B. Bernanke "must" still cause monetary inflation [ i.e. a decrease in the per unit value of each $], sooner or later, despite the fact that this has still not occurred to date, [ for various reasons].

Others will claim that the "tightening" of the monetary base evident under the Yellen "regime" ensures a recession in the near future [2018 onwards].

I Claim: I will claim that either side might get it right, but that if they do, that it is not a sign of their own ability to predict the economic future, as many might believe, but only that the party concerned got lucky, nothing more.

Fig.4: Gold bullion prices, daily, 2008-17

Fig. 6: Aaa U.S. Corporate Bond Yields, Monthly, 1920- 2017 [Nov.]

Fig. 5: 30 year U.S.Treasury Bond Interest Rates, Monthly, 1975- 2017[Nov.]

Fig. 6: Aaa U.S. Corporate Bond Yields, Monthly, 1920- 2017 [Nov.]

Human Action Versus Predicting The Economic Future

For many fundamental reasons to do with human action that I will not get into here, the precise economic and financial future must remain unknown. Which means that although inflation might be next, continued "disinflation", or even deflation has just as just much chance of occurring, as does a return to economic "good times" .

Bottom Line: Serious Risk For You and Your Precious Savings:

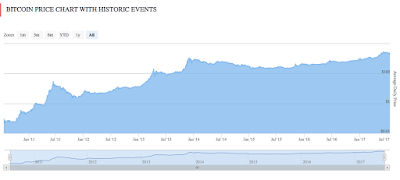

If your savings and investments in any way rely on your supposed ability, [or somebody else's supposed "professional" ability], to accurately predict future economic and financial scenarios via charts like those above, or via "fundamental" or "technical analysis", or via tea-leave readings, astrology or whatever else [!], then unless you/they are extremely lucky individuals, your entire savings portfolio is at serious risk of decimation.

Regards, Financial Safety Services : onebornfreeatyahoodotcom

Related posts: "Mr. Ben Bernanke: The Great[est] Inflator ?"

"Will The Yellen Fed Cause a Trump Recession?"

image source

*****************************************************************

image source

*****************************************************************